What is social listening? A guide for senior marketers in 2026

In this blog:

What social listening really is (and what it isn’t)

What social listening looks like in practice

What this looks like inside a social listening platform

Why social listening belongs in your budget

The market data behind it all

How high-performing marketing and content teams leverage social listening

Social listening FAQs

For senior marketers, social listening has quietly shifted from a tactical ‘nice to have’ into a strategic decision-making engine.

It’s no longer just about ‘tracking mentions’ or ‘replying faster on X or LinkedIn’ to your audience. Done properly, social listening can reveal unmet demand, competitive gaps, early signs of reputational risk, and the language your audience actually uses; and often months before it shows up in any internal reporting dashboards or sales data.

This guide explains what social listening really means in 2026, why it matters if you’re leading a marketing or content team, how it works in practice, and how you can wield it to turn raw data into revenue-impacting insight.

What social listening really is (and what it isn’t)

At its core, social listening is the practice of collecting and analysing publicly available online conversations across social platforms, forums, blogs, reviews, and news to understand how people feel, what they care about, and how those perceptions are changing over time.

What it is not about:

Scheduling posts

Measuring likes in isolation

Manually scanning comments.

All of the market-leading social listening platforms use AI, natural language processing, and machine learning to identify patterns, sentiment shifts, and emerging topics at scale.

The output isn’t more data… it creates clearer signals for so that your brand can be more ‘strategic’ in its actions.

What social listening looks like in practice

If you’re thinking of being the person who handles social listening work, you should know upfront that social listening isn’t just something you ‘switch on’ and instantly get insight from. It’s an iterative process that starts with asking the right questions and refining them until the data you’ve collected becomes meaningful (beyond that, you may be expected to collate and compile all that analysis into a presentation deck so that the insights can be shared on internally or with a client).

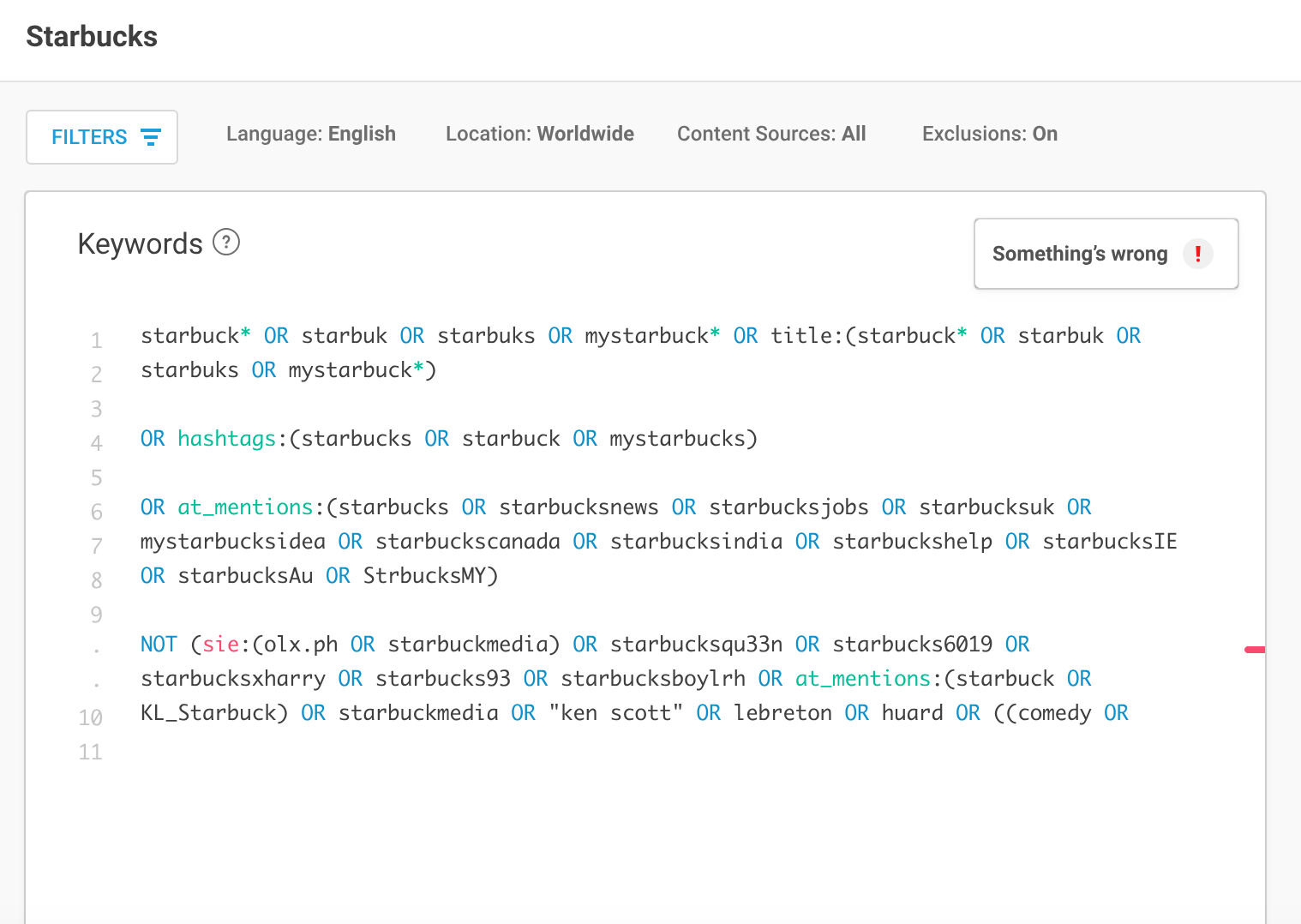

Most social listening platforms work by allowing you to build queries (sometimes also known as ‘query strings’). These queries define what conversations you want to capture across social platforms, forums, blogs, review sites, and media sites.

(Note: I’m using some screenshots of Brandwatch’s platform throughout this article, as I worked with it for 3+ years, so I’m most familiar with that user interface.)

Above: A typical example of a query (written within the Brandwatch platform).

Step 1: Start with a focused question, not a keyword list

Effective social listening begins with intent.

For example, you may want to get to the bottom of one of these questions:

How do people talk about our brand when they’re frustrated?

What language do our prospects use when comparing us to competitors?

What do our customers say about the product features on our latest coffee machine model?

Starting with a vague goal like ‘track brand mentions’ usually produces noisy, low-value data. The trick is to be specific, right from the very beginning.

Step 2: Build an initial query

A basic query might include elements like:

A brand name or product names

Category or industry terms

Competitor brand names

Any relevant hashtags or phrases.

At this stage, results are often too broad and will pretty much always pull in a lot of irrelevant mentions, off-topic conversations, or false positives (for example, words that have multiple meanings).

And that’s normal.

Step 3: Refine your query to remove the noise

This is where most of the real work happens.

You typically refine a query by:

Excluding unrelated terms or contexts

Adding qualifiers to capture intent (e.g. ‘recommend’, ‘problem’, ‘alternative’)

Segmenting by a region, a language, or a certain platform

Separating customer conversation from media or brand-owned content.

Each refinement reduces volume but increases signal quality, which is far more valuable for strategic decision-making. You can expect to go through this process multiple times though, before you finally land on the super relevant pool of data you were looking for.

Step 4: Validate what the data is actually showing

Before acting on any initial insights from the data you’ve collected, it’s a good idea to spend some time sense-checking your results by:

Manually reviewing a sample of mentions

Stress-testing assumptions (“Is this a real trend or a short-lived spike?”)

Comparing different query versions, side by side.

This step helps ensure that any conclusions you draw aren’t based on misleading data or ‘edge’ cases.

Step 5: Turn the data into insight… and the insight into action

Once you’re confident that your query is delivering relevant data, you may begin to see patterns emerging:

Repeated pain points

Consistent language used to describe the same problem or complaint

Shifts in sentiment over time

Differences in how competitors are discussed.

The final (and most important) step is translating those patterns into decisions; whether that’s adjusting product messaging, shaping campaign themes, refining brand positioning, or even flagging emerging risks to your leadership team.

What this looks like inside a social listening platform

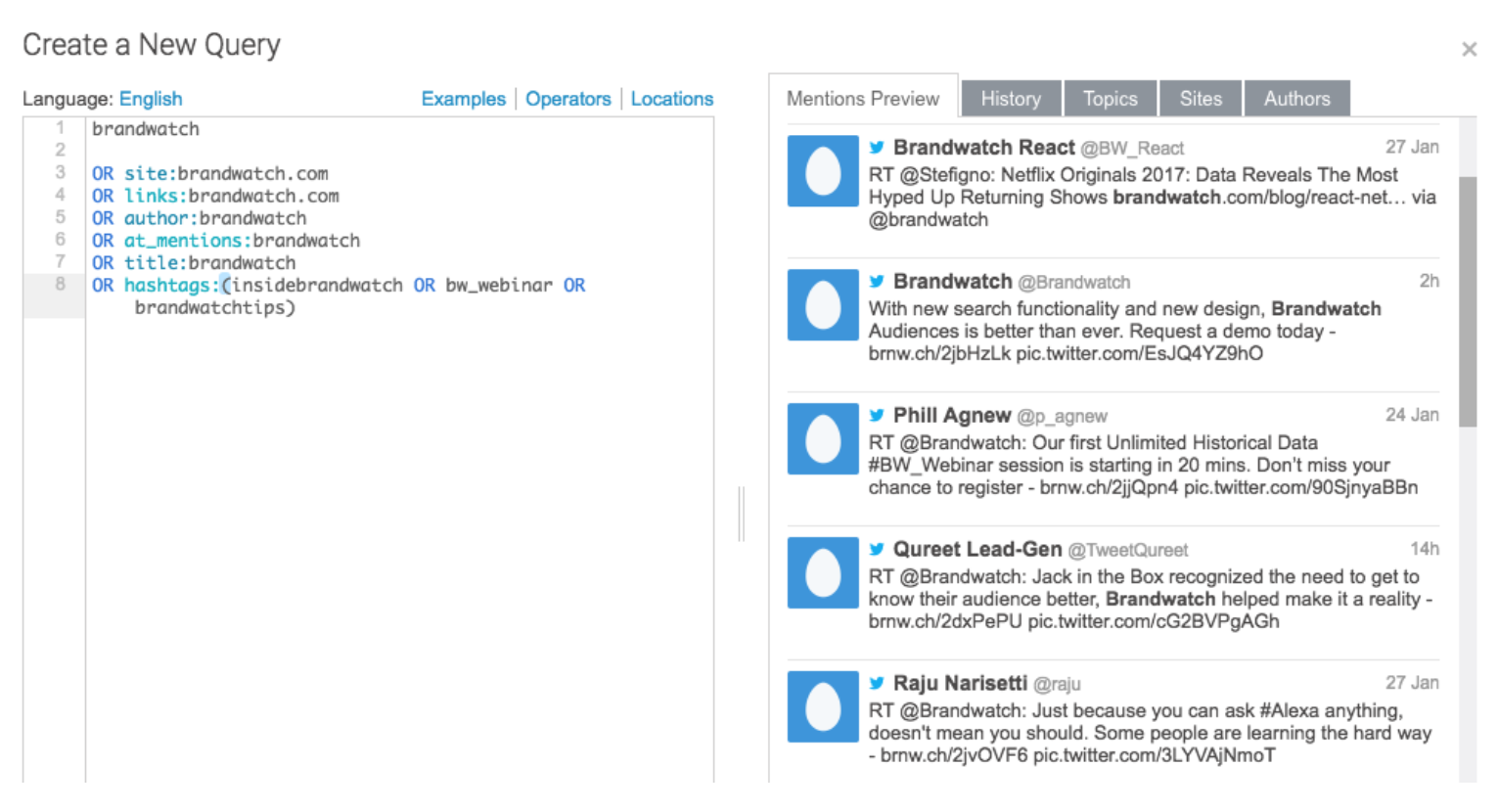

Most enterprise social listening tools, including platforms like Brandwatch, visualise query results through a small set of sample results. These help you to quickly assess whether your query is working well before you go ahead and run the full search for social listening data.

Above: A quick example of sample results (taken from Brandwatch).

Once you run your query, here are some basic categories of data you’ll likely see in the results:

Conversation volume over time

One of the most common social listening metrics is a simple timeline of ‘mentions’.

If mentions spike unexpectedly, you may start to ask:

Is this tied to a real-world event?

Was there a campaign launch?

Is this just ‘noise’ caused by my overly-broad query?

Sharp spikes often trigger query refinement or deeper investigation.

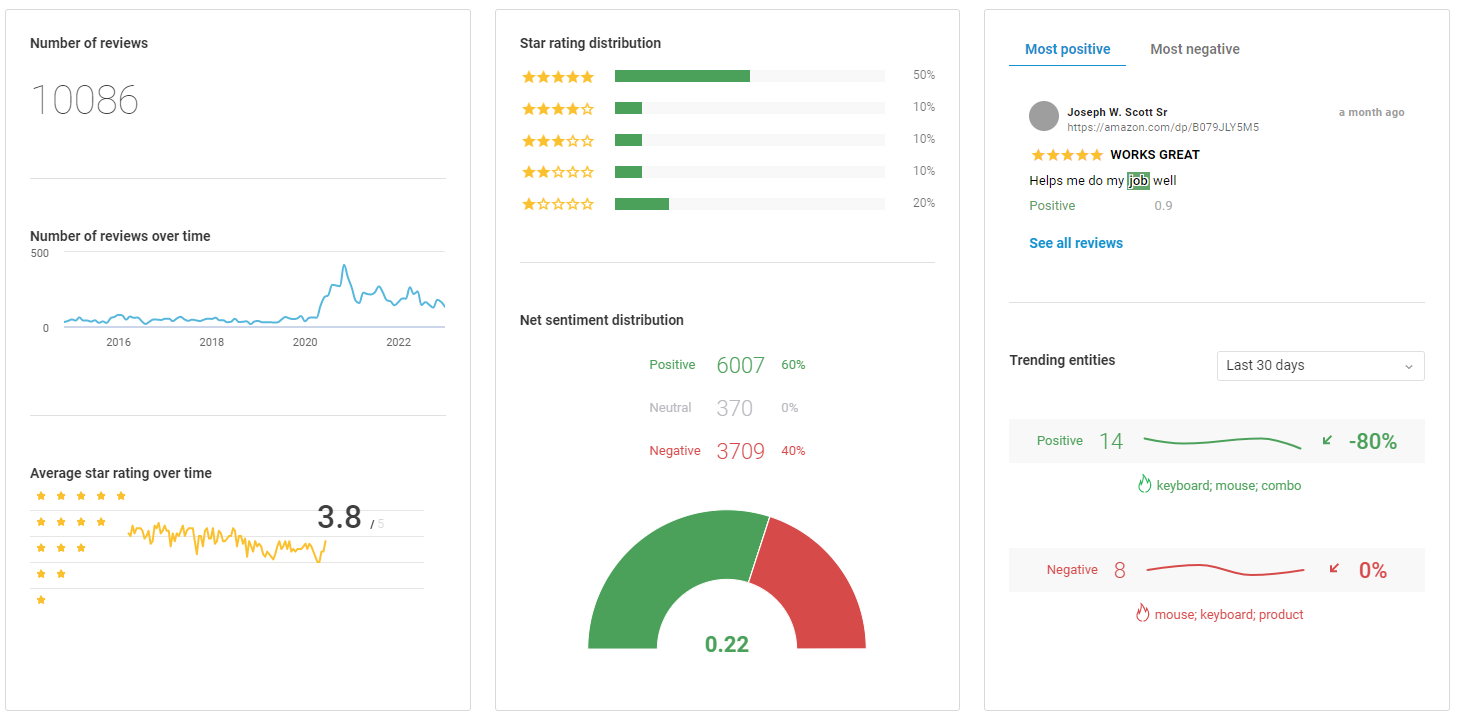

Sentiment distribution

Visual sentiment breakdowns help validate whether conversations are genuinely positive, negative, or mixed. It’s the aerial view on how your audience is feeling and what they’re saying, rather than isolated anecdotes.

Above: Example of a Brandwatch dashboard, focused on audience sentiment

Marketing and content teams can use this type of information to distinguish:

Structural dissatisfaction from short-term complaints

Brand issues from broader category frustration.

(You can, of course, dig deeper into the data and view all of the individual comments and mentions that made up the results in your dashboard view.)

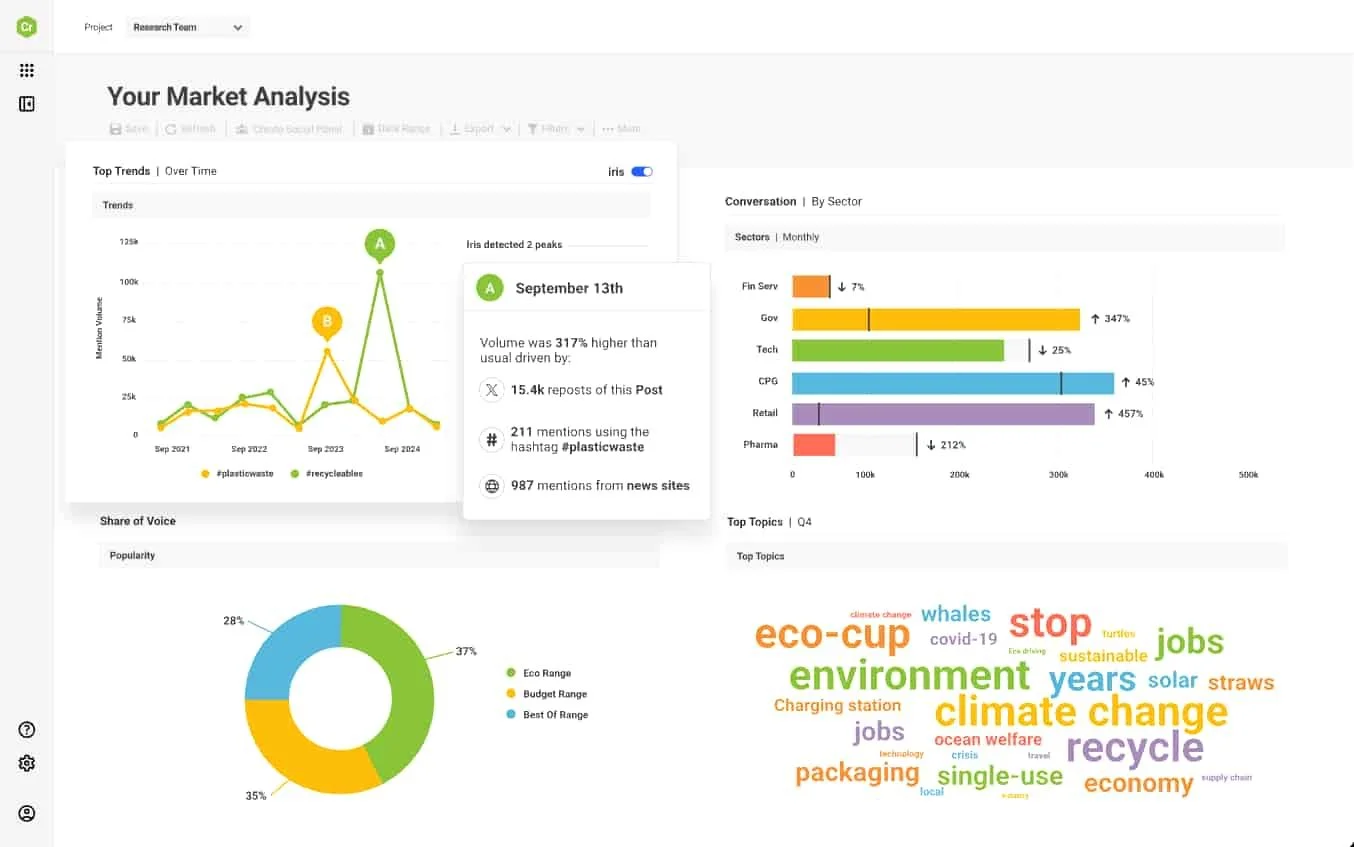

Topic and theme clustering

Many platforms automatically surface recurring topics within a query.

This is where patterns become visible:

Repeated buying objections

Frequently mentioned competitors

Language customers consistently use to describe problems.

And for marketers and content strategists, these clusters are often where ideas for new messaging, positioning, and campaigns come from.

Above: This Brandwatch dashboard shows a wordcloud, breakdown of industries, and more.

Manually inspecting the data

Despite automation, you should still review the ‘raw mentions’ if you can.

Visual feeds allow marketers to scan all the individual results and confirm that:

The context hasn’t been misinterpreted by the social listening tool

Your query captures genuine customer conversation

The insights reflect reality, not algorithmic artefacts.

This step is critical before insights are shared more widely!

Why social listening belongs in your budget

1. It surfaces demand before your competitors see it

“Search data shows what people already know they want. Social listening data can show what people are starting to care about.”

Early-stage pain points, language shifts, and unmet needs tend to appear first in organic conversation, not in surveys or by using keyword tools.

It gives marketing leaders a rare opportunity: to shape positioning and product narratives before competitors have a chance to react.

2. It reduces strategic blind spots

Internal data tells you what customers did. Social listening helps explain why.

By monitoring competitor mentions and category conversations, leadership teams gain real-time visibility into:

Perceived strengths and weaknesses across the market

Feature gaps customers talk about openly

Messaging claims that resonate… or fall flat

This context is difficult to obtain through traditional research alone.

3. It supports risk management and brand protection

Reputational damage rarely arrives without warning. Negative sentiment typically builds in clusters, a spike in complaints, influencer criticism, or misinformation, long before it becomes a crisis.

“Social listening enables early detection and measured response, rather than reactive damage control.”

The market data behind it all

Investment in social listening reflects its growing strategic value:

The global social media listening market is projected to exceed $25 billion by the early 2030s, driven by demand for real-time consumer intelligence.

Over 60% of marketers say social insights now inform campaign strategy, product positioning, or executive reporting.

Brands using social data alongside traditional analytics report stronger campaign relevance and faster insight cycles than those relying on performance data alone.

“Social listening is moving out of the ‘social media management’ category and into strategy, insights, and brand leadership teams.”

How high-performing marketing and content teams leverage social listening

Top-performing marketing organisations don’t treat listening as a standalone function. Instead, they connect insights to specific outcomes:

Brand strategy: Tracking how brand associations evolve over time

Campaign planning: Identifying themes and language already resonating

Product marketing: Monitoring feedback around features, pricing, and usability

Customer experience: Spotting recurring friction points earlier

Competitive intelligence: Understanding where rivals disappoint customers

The common thread here? Insight is only valuable when it informs decisions.

Social listening FAQs

-

Social listening is the process of monitoring and analysing online conversations across social media, forums, blogs, reviews, and news to understand audience sentiment, emerging trends, and brand perception.

Unlike social media management, it focuses on insight rather than posting or engagement. -

For marketing and content teams, social listening provides early insight into customer needs, competitive gaps, reputational risk, and market trends.

It also helps leadership teams make better strategic decisions based on real customer language and behaviour, not just internal data.

-

Social monitoring tracks mentions and keywords in real time.

Social listening goes further by analysing sentiment, patterns, and changes over time to inform strategy, messaging, and business decisions.

-

Enterprise teams often use tools like Brandwatch, Sprout Social, and Talkwalker.

Each offers different strengths, from deep consumer intelligence to integrated workflows and real-time sentiment detection.

-

Brands use social listening to guide brand positioning, identify campaign themes, detect early reputation risks, inform product marketing, and understand how customers perceive competitors in the market.

-

When insights are actively used, social listening can improve campaign relevance, speed up decision-making, and reduce wasted spend.

Its impact depends on how well insights are connected to execution and business outcomes.

Now that you’ve read this, you may be interested in: